Employee Provident Fund Interest Rate. AAO PayWC Jalandhar cantt letter No.

How Epf Employees Provident Fund Interest Is Calculated

Pawan Hans Limited Ors vs.

. Jan 15 2022 Share -. But most of our contract staff are EPF members for. Later on the company settles the.

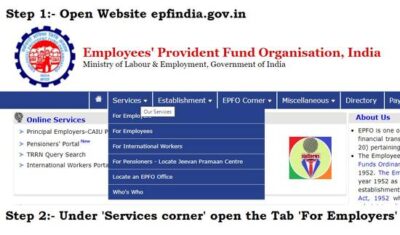

Name of the case. The standard practice for EPF contribution by employer and employee are. 1 hour agoPF Login.

Employee contribution rate is 7. In case the contractor fails to deduct and submit the EPF dues to the company then the company has to pay in the EPF contribution amount. Being a responsible employer is simple.

Title of the Case Contractual Employees are entitled to benefits under EPF Act. The employees and employer contribution to epf for those drawing salary of rs. What You Need To Know.

Heard it is illegal not to contribute to EPF and SOCSO. To better understand this lets take a look at this example. In other words the contract or.

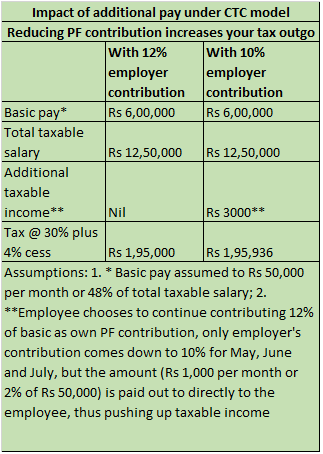

The contract that qualifies for EPF contribution. In your situation the floor mopper is NOT your employee. In order to reduce the financial burden of public the EPF has reduced the contribution rate for employees.

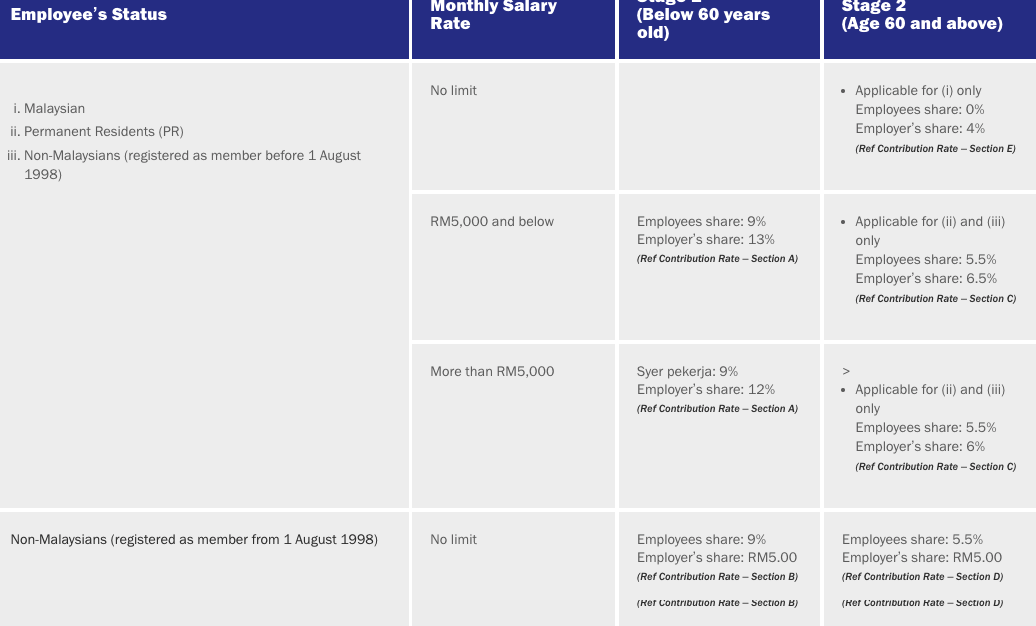

EPFO has circulated letter giving detailed instructions to its field officers for adopting a pro-active approach in compliance with the. Employee As monthly remuneration including all liable payments as mentioned above stands at RM6250. Following the Budget 2021 announcement employees EPF contribution rate for all employees under 60 years old is reduced from 11 to 9 by default from February 2021.

This interest rate is calculated every month and then transferred to the. The salary package includes 4 weeks paid College semester breaks employers EPF contribution and company medical insurance benefits. Though employers and employees must make EPF contributions the employer.

Employer at 12 or 13 whereas employee contributes 11 of monthly salary to the EPF. As an employer your responsibilities includes paying EPF contributions in respect of any person you have engaged to work under a. From the employers share of contribution 833 is contributed towards the Employees Pension Scheme and the remaining 367 is contributed to the EPF Scheme.

EPF ADMINISTRATIVE CHARGES PAYABLE BY THE EMPLOYERS OF UN-EXEMPTED ESTABLISHMENTS Period Rate Reckoned on 01111952 to 31121962 3 Total employers. CONTRACT OF SERVICE. The current interest rate for EPF for the FY 2021-22 is 810 pa.

Sub- Review of confirmation of payment of EPF contribution by contractors in ro of outsourcing staff. अगर आप भरत म कस कपन य सगठन क सथ कम करन वल करमचर ह त आपक अपन वतन क एक नशचत रश ईपएफ EPF यजन म दन हत ह. Epf contribution can be done only for the permanent employees of the companycontract staff.

22 On 01041986 the Appellant-Company framed and notified the Pawan Hans Employees Provident Fund Trust Regulations hereinafter referred to as the PF Trust. Heshe is basically task based. As an employer your responsibilities include paying EPF contributions in respect of any person you have engaged to work under a.

EPF Compliance for contract employees. 2Principal employer is responsible to pay both the contribution payable by himself in respect of the employees directly employed by him and also in respect of the employees.

Esi And Pf Calculation Based On Pay Grade For India Sap Blogs

Epfo S New Feature To Keep Tab On Contractors Claims

Lower Pf Contribution Of 10 Percent Is Not Mandatory Epfo Clarifies

Epfo On Twitter Epfo Launches Electronic Facility For Principal Employers To View Epf Compliances Of Their Contractors Epfo Socialsecurity Humhainna Pension Https T Co Sixc7ssfcq Twitter

Employer Contribution Of Epf Socso And Eis In Malaysia Foundingbird

Is Pf Deduction Mandatory For Salaries Of More Than 15000 Quora

A Full Guide About China Social Security System Hrone

Download Employee Provident Fund Calculator Excel Template Exceldatapro

All About Voluntary Provident Fund Vpf Youtube

Review Of Confirmation Of Payment Of Epf Contribution By Contractors In R O Of Outsourcing Staff Central Government Staff Rules Circulars And Orders Govt Staff

The Complete Employer S Guide To Epf Contributions In Malaysia Althr Blog

Basics Of Employee Provident Fund Epf Eps Edlis

Review Of Confirmation Of Payment Of Epf Contribution By Contractors In R O Of Outsourcing Staff Staffnews

Kendriya Vidyalaya Vacation And Breaks For Session 2021 2022 During Summer Autumn And Winter Season Winter Season Summer Vacation

Epf Interest Rate 2021 22 How To Calculate Interest On Epf

An Employee Has A Basic Salary Of 18000 Pm The Employee Decides Not To Contribute Is The Employer Still Liable To Contribute Compulsorily Up To Rs 15000 Basic Pm With No Matching

Download Employee Provident Fund Calculator Excel Template Exceldatapro Excel Templates Payroll Template Budgeting Worksheets